Investments

NHRS pursues an investment strategy designed to achieve its long-term funding requirements. The goal is to meet or exceed the retirement system’s assumed rate of return over the long term, while at the same time managing the risk, return, and liquidity of the portfolio.

The Board of Trustees, with research and input from NHRS investment staff, outside experts, and a recommendation from the Independent Investment Committee (IIC), set an investment policy that includes asset allocation targets and acceptable ranges.

The IIC, which was established by statute on January 1, 2009, manages investments based on the trustees’ policies, continuously monitors and evaluates performance, and makes determinations regarding the hiring and retention of fund managers. By law, all IIC members must have “substantial experience in the field of institutional investment or finance.”

More information regarding the NHRS investment portfolio can be found in the Annual Comprehensive Financial Report or the Comprehensive Annual Investment Report, both of which are available here.

More detailed information regarding the NHRS investment policies can be found in the Investment Manual

Investment Performance

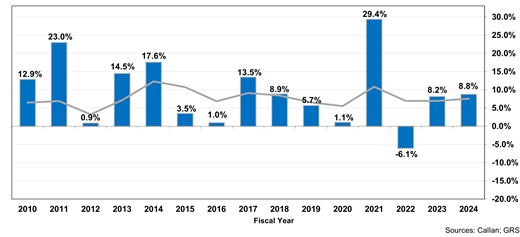

The retirement system realized an 8.8% return on investments in the fiscal year ended June 30, 2024.

The three-year, five-year, 10-year, and 25-year returns for the periods ended June 30, 2024, were 3.4%, 7.7%, 7.0%, and 6.3%, respectively. All returns are net of fees.

The retirement system’s assumed rate of investment return is 6.75%.

NHRS FY 2024 Investment Returns

Quarterly Investment Updates

Time-Weighted Annual Returns 2010-24

Assumed Rate of Return

The current assumed rate of return is 6.75%. This rate represents what the Board of Trustees believes the plan can realistically earn from its investments on an annual basis, when averaged over the long term. In any given year, investment returns are likely to be higher or lower than the long-term assumed rate.

The determination of an investment return assumption, which is typically based on a 30- to 50-year time horizon, involves careful review of several financial, economic, and market factors. This long-term approach promotes predictability and stability of plan costs and contribution rates. The assumed rate of return – along with other demographic and economic assumptions – is regularly reviewed by the Board of Trustees and may be adjusted periodically to better reflect the retirement system’s actual experience.

Diversification of Investments

An asset allocation is designed to diversify an investment portfolio to minimize risk and maximize performance.

The target (left) and actual (right) allocations as of June 30, 2023, for NHRS are shown on the charts below.

Domestic Equity is primarily made up of stocks in U.S. companies. Non-U.S. Equity contains stocks of foreign companies. Fixed Income includes bonds and cash with the objectives of providing current income and preserving capital. Real Estate includes directly-owned properties as well as investments in commingled real estate funds. Alternative Investments primarily include private equity and private debt limited partnerships that are not traded in the public market.

Proxy Voting

A proxy is a written power of attorney given by a shareholder of a corporation, authorizing a specific vote on the shareholder’s behalf at corporate meetings. A proxy will normally pertain to election of members of the corporation’s board of directors, or to various resolutions submitted for shareholder approval. The NHRS Proxy Voting Policy has been established to protect the retirement system’s long-term investment interests and to promote responsible corporate policies and activities which enhance a corporation’s financial prospects.

Proxy Summary

| CY 2024 |

For |

Against |

Abstain/

Withhold |

Total |

| Management Proposals |

12,577 |

1,249 |

542 |

14,368 |

| Shareholder Proposals |

158 |

83 |

388 |

629 |

| Total |

12,735

(85%) |

1,332

(9%) |

930

(6%) |

14,997* |

* Does not include 84 “Say on Pay Frequency” votes, as these are not voted on a For or Against basis, but are voted for either One-,Two-, or Three-Year terms.